Maximize Your Retirement Income Without Sacrificing the Life You Love

We help couples over 40 create a tax-efficient retirement income plan that ensures you never run out of money — and protect your legacy for future generations.

Why Clients Choose Legacy Provider Group

Clarity in 30 minutes: We can show you where you stand and answer the 4 most important financial questions quickly.

Real financial modeling: Our financial software analyzes your entire dollar and uncovers hidden wealth transfers.

Education funded for you: Workshops & resources included — no extra cost.

Risk-aware strategies: Smart balance of growth and protection to reduce downside risk.

Dedicated to your legacy: Protecting tomorrow without sacrificing today.

Here's How to Get Started:

Attend the Thrive During

Retirement Workshop

Learn the core principles of secure retirement planning.

Book Your Retirement

Readiness Session

Get answers to the 4 most important financial questions.

Complete Your

Estate Planning

Create your Will/Trust, directives, and organize estate information.

About Us

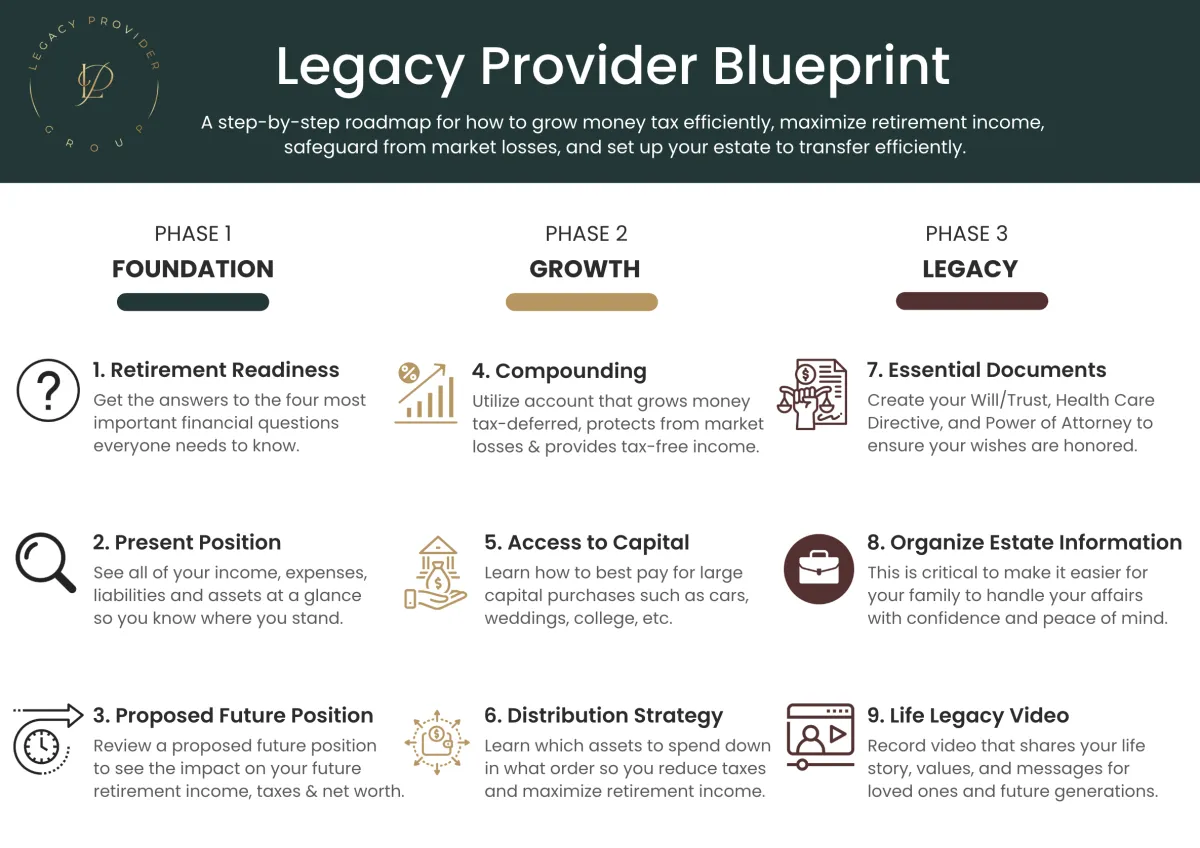

We are female-led financial firm headquartered in San Diego, CA and Los Cabos, Mexico offering a unique virtual wealth experience that empowers our clients to achieve financial independence through education, smart strategy, and tax-driven planning. Our Legacy Provider Blueprint is a proven method for securing your retirement income and legacy.

WHAT WE OFFER

Our Services

Retirement Income

Planning

Build a reliable monthly income you won’t outlive.

Tax-Efficient Growth

& Protection

Keep more of your money now and in retirement.

Wealth Creation

- Your Way

Grow assets with strategies tailored to your goals.

Legacy & Estate

Planning

Pass wealth with confidence — not stress.

ADDITIONAL

Resources

Finance

Financial Foundations Course

Our free six lesson course covering foundational financial concepts key to a successful retirement.

Travel

From Bucket List to Boarding Pass

Learn how to earn trips, save on travel, and create extra income — without complicated systems or prior experience.

Career

Brand to Booked™ Launch Build

Turn your expertise into income with a personal brand site and automated client-booking workshop that consistently fills your 1:1 calendar.

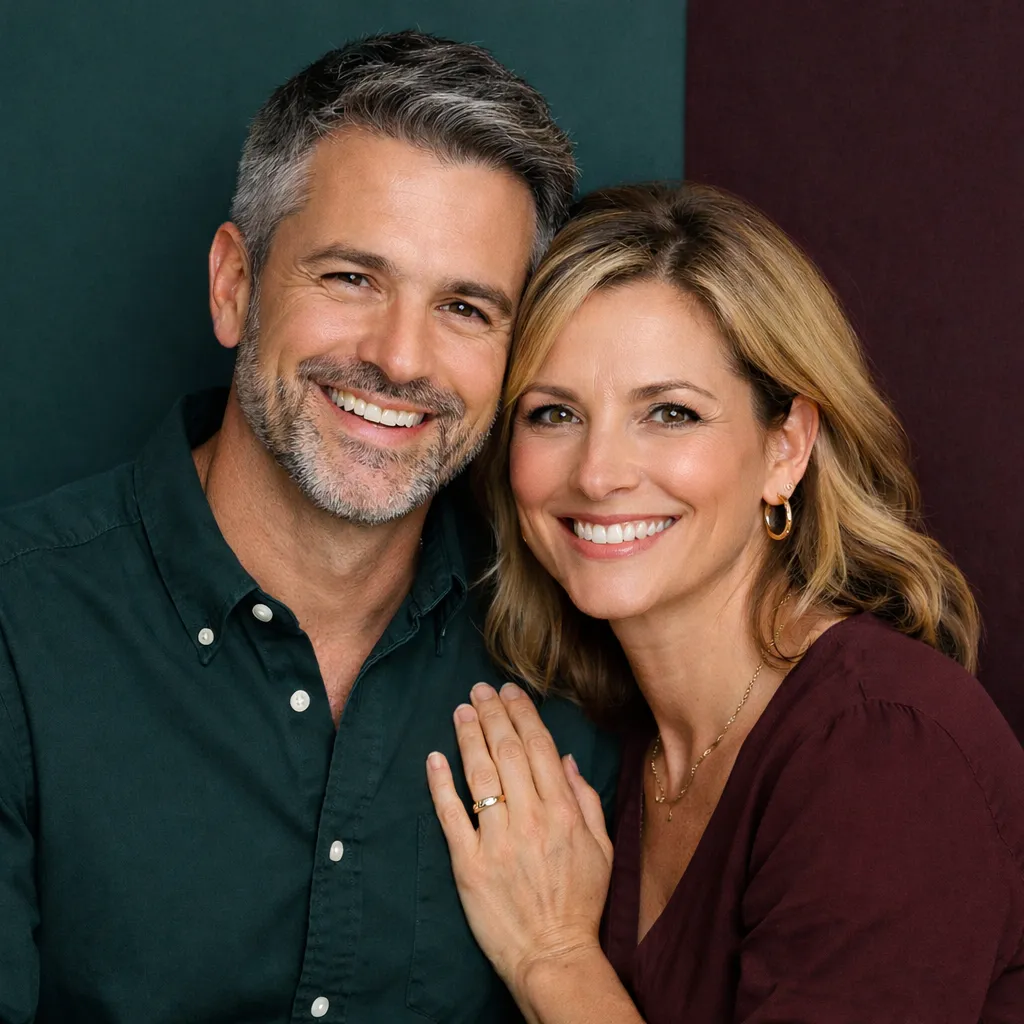

Our Leadership Team

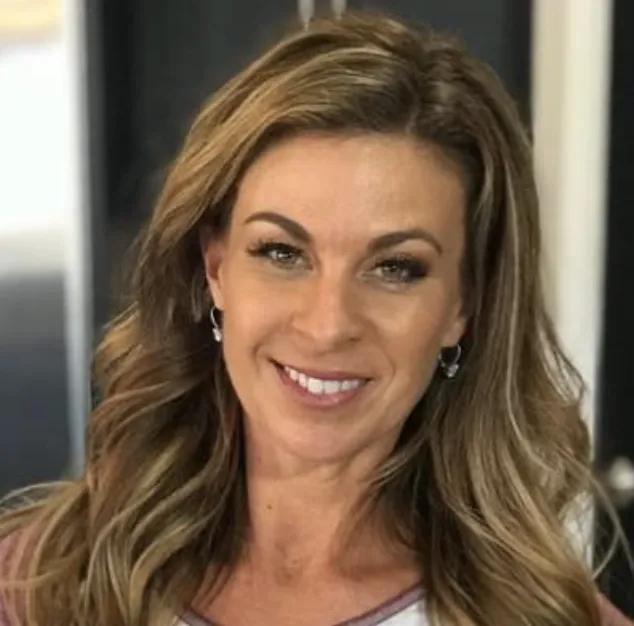

Jenn Seeger

Founder & CEO

Over 20 years experience in the financial services and marketing industry. Recognized as one of the Top “40 Under 40” Outstanding Young Leaders in San Diego.

Learn more...

Merle Gilley

Chief Cash Flow Strategist

& Lead Advisor

What Clients Are Saying...

"Thanks for showing me how to increase my tax-free retirement income, reduce my taxes, and increase my estate by over a million dollars without affecting my lifestyle." — Randy, Brentwood, CA

Thanks to your planning process I learned how to increase my tax-free retirement income no matter what the market does!" — Crystal, Alpine, CA

FAQ's

How is the Legacy Provider Group different from other advisors I have met with?

Great question! Below are ways we are unique:

1) We can answer the 4 most important financial questions in under 30 minutes, which include:

1. Do you know what rate of return you need to earn on the money you have today to be able to live in the future like you live today, adjusted for inflation, without running out of money before your life expectancy?

2. Do you know how much you need to be saving on a monthly or annual basis to make sure you will have enough in the future for you to live like you live today adjusted for inflation?

3. Do you know how long you will have to work doing what you are doing now before you will be able to live on what you have accumulated and your money last to your life expectancy?

4. Do you know how much you will have to reduce your standard of living during retirement to keep your money from running out before your life expectancy?

2) We are experts at doing financial modeling of your current position, helping you maximize retirement income, and ensuring you never run out of money through the development of an efficient distribution strategy.

3) We provide additional educational resources to everyone that meets with us at NO charge.

4) We are uniquely trained at helping you eliminate unseen and unnecessary losses.

In 2025, the average American family saves only 4 cents of every dollar earned and spends the other 96. Most financial advisors focus on providing investment strategies for only those 4 cents. We take a very different approach where we analyze the entire dollar and specialize in finding areas of your spending that are creating unseen wealth transfers. Assume you earn $100,000 a year, save 4%, and make a 5% rate of return on your savings – that equals $200 in investment returns. If we can help you find just 2% of your earnings in hidden wealth transfers, you could save $2,000 more a year. That increases your rate of return on your existing savings from 5% to 55%, without taking any additional risks!

We believe there is more money to be had by avoiding the losses than in trying to pick the winners.

The 5 Major Wealth Transfer Areas:

1. How you pay for your house

2. How you fund your Qualified Plan

3. Taxes

4. Education expenses

5. Major capital purchases

How can the Retirement Readiness Session be free?

We are compensated directly by the financial companies we work with, which means you don’t pay out of pocket for our services! These companies pay us for placing business with them, but the important part is that it has no negative impact on you—your costs, fees, and investment options remain the same whether you work directly with the company or through us. The advantage for you is that you get our additional free resources, guidance, ongoing service, and support at no additional cost to you.

Due to this structure, you are eligible for a FREE consultation if you live in the Unites States and meet the below qualifications:

- You are serious about building real wealth and retirement income.

- You are saving at least 10% of your income.

- You have $250K+ in assets.

- You are open to a transparent, full financial review.

- You want to maximize your financial future without sacrificing your current financial situation.

What benefits should I look for in a retirement savings account?

If you could wave a magic wand which of the below account benefits would you desire?

- Tax-Deferred Growth as opposed to taxable

- Tax-Free Distribution so the money comes out tax-free at retirement

- Competitive Rate of Return on the money

- High Contributions so you can contribute as much in the account as you desire without restrictions

- Protection Against Disability where contributions to the account continue even though you can no longer make them yourself

- Collateral Opportunities so you are able to use the money as collateral

- Creditor Protection in the event of a lawsuit

- No-Loss Provisions where the interest on the account is guaranteed

- Guaranteed Loan Options with the ability to demand a loan at a competitive rate

- Unstructured Loan Payments providing the ability to make loan repayments in any manner that you see fit

- Liquidity, Use and Control so you have access to the money while you are working, as well as during your retirement

- Deductible Contributions so you defer the future tax and tax calculation on money owed

There is only ONE type of account structured in a specific way that offers almost all of the above benefits. We specialize in this type of savings account and we cannot wait to share it with you!

Which benefits do you get from a Qualified Plan (i.e. TSP, 401(K), IRA)?

Tax Deferred Growth, Competitive Return, Creditor Protection, and Deductible Contributions

Do I have to be exposed to stock market risk in order to take advantage of market growth?

The short answer is NO. Let us explain:

In the financial world there are two types of financial advisors: those that specialize in the speculative facet, and those who specialize in the fixed facet. Rarely do you find an advisor that specializes in both: as these really are two very different worlds. Advisors that specialize in speculative investing pride themselves in selecting publicly traded companies to place money in with the hope the investment will render a higher return over time than more predictable fixed investments. This philosophy or approach works well until there is an unforeseen economic correction. There is risk in speculative investing that is fine as long as the person doing the investing has ample time to make up for the inevitable market corrections.

Advisors that specialize in the fixed investment world of finance eliminate risk associated with speculative investing. The perceived disadvantage to those interested in implementing safe fixed investments over speculative investments is the fear of missing out on the upside potential of the stock market gains. This is a misconception, and we want to show you why.

At Legacy Provider Group, we specialize in working with fixed index products that emulate the upside potential of the stock market, without the downside risk.

This sector of the financial industry has only been around for 25 years, and there are very few financial professionals that understand how to use these products to benefit the client as well as our team does.

Everyone who is serious about growing and protecting their money should have a portion of their money in an indexed product to protect from market volatility and sequence of return risk. Using the right product - and the right company - is very important. Designing the product correctly to optimize the money is absolutely critical.

We can help you to analyze your current financial position to help you determine:

1) How you can best balance your speculative and fixed accounts so as to minimize taxation, and market risk.

2) How much you need to be saving in order to retire when you want and never run out of money.

3) How you can save more without impacting your current lifestyle.

Headquarters:

San Diego & Cabo San Lucas

Facebook:

@legacyprovidergroup

Instagram:

@legacyprovidergroup

Website:

LegacyProviderGroup.com