Book My Retirement Readiness Session

What's included in this FREE consultation?

Four Questions Report

Provides answers to the 4 most important financial questions:

1) Do you know what rate of return you need to earn on the money you have today to be able to live in the future like you live today, adjusted for inflation, without running out of money before your life expectancy?

2) Do you know how much you need to be saving on a monthly or annual basis to make sure you will have enough in the future for you to live like you live today adjusted for inflation?

3) Do you know how long you will have to work doing what you are doing now before you will be able to live on what you have accumulated and your money last to your life expectancy?

4) Do you know how much you will have to reduce your standard of living during retirement to keep your money from running out before your life expectancy?

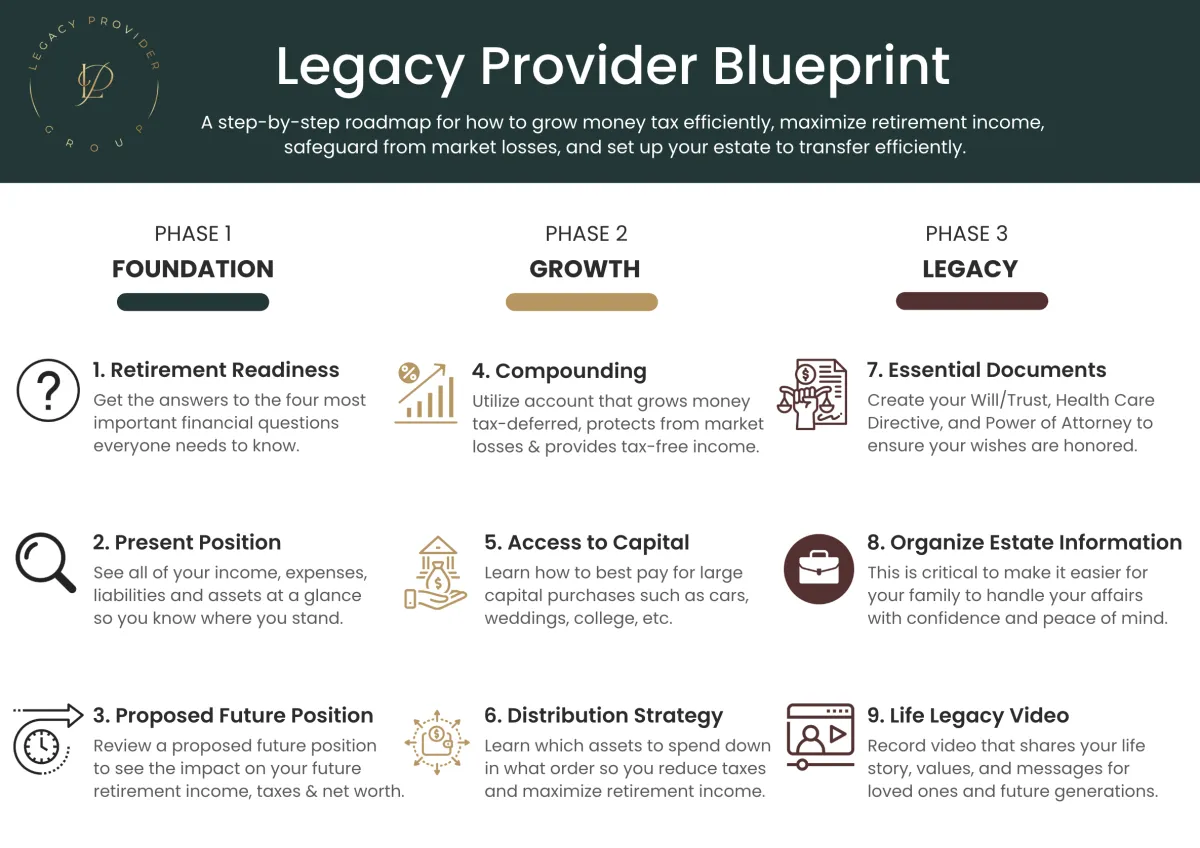

Legacy Provider Blueprint

A roadmap for growing money tax efficiently, maximizing retirement income, safeguarding from market losses, and setting up your estate to transfer efficiently.

Legacy Provider Checklist

Use this checklist to ensure you have completed the steps needed to secure your retirement income so you have financial freedom for life.

Saving Vehicle Scorecard

Use this to analyze the benefits of various savings vehicles.

Financial Independence Book

Learn the 8 major risks that could derail your retirement.

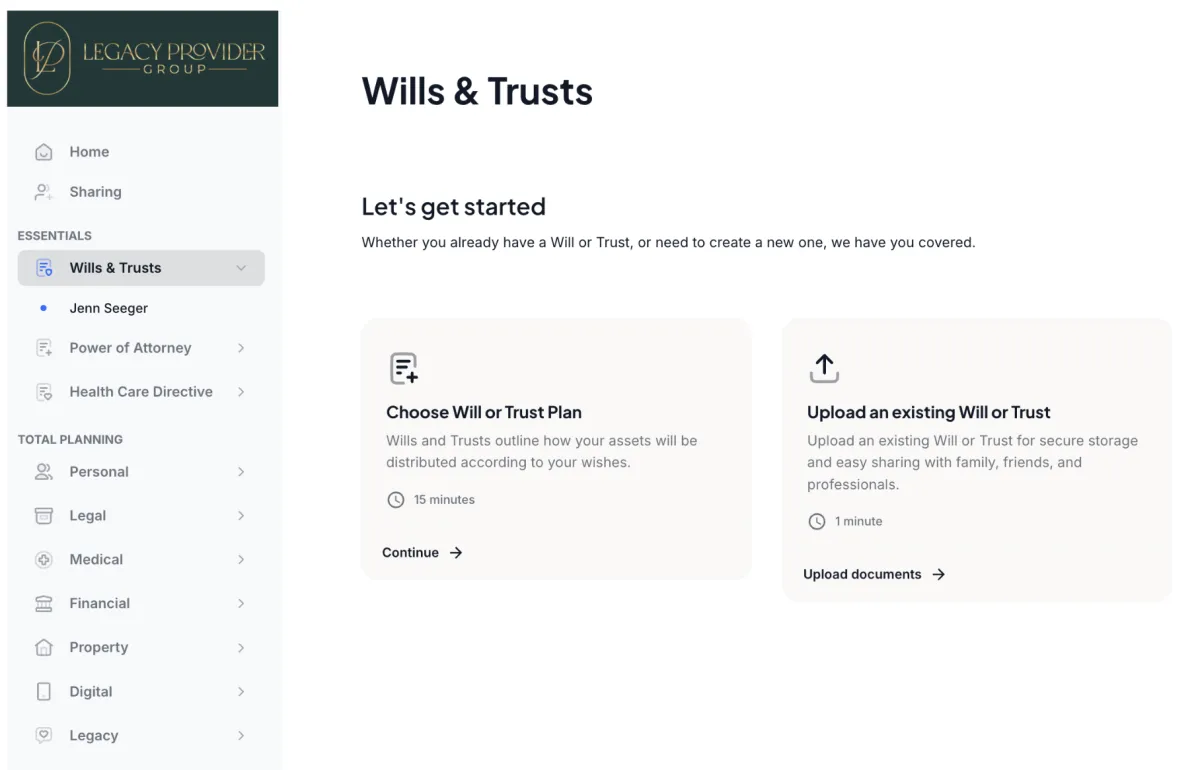

Legacy Planning Portal

We will give you a private portal for completing your essential legal documents (i.e. Will, Trust, Power of Attorney, Health Care Directive) and getting your estate information organized.

What Clients Are Saying...

"Thanks for showing me how to increase my tax-free retirement income, reduce my taxes, and increase my estate by over a million dollars without affecting my lifestyle." — Randy, Brentwood, CA

Thanks to your planning process I learned how to increase my tax-free retirement income no matter what the market does!" — Dawn, Lakewood Ranch, FL

Headquarters:

San Diego & Los Cabos

Call:

858-775-8425

Email: [email protected]

Website: LegacyProviderGroup.com